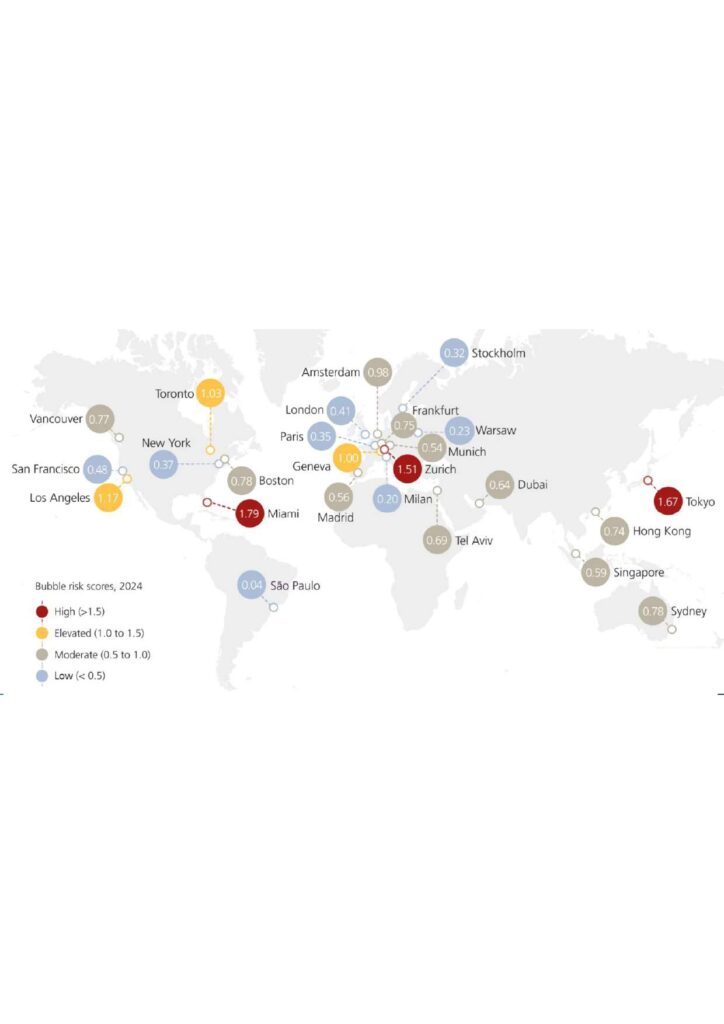

Which countries are at risk of a property price bubble?

Swiss bank UBS has published a report on the state of the global real estate market, presenting the results of the study for 2024.

The Global Real Estate Index is based on a detailed analysis of key indicators, such as:

- The ratio of real estate prices to yield and rental costs;

- The dynamics of lending to GDP;

- The difference in real estate prices between the city and the country as a whole.

The main conclusion of the study: risks in the global housing market have begun to decline on average for the second year in a row. If risks continue to decline in Europe, they will grow in the United States. In the countries of the Asia-Pacific region, the threat level remains stable.

Cities with the highest risk of a price bubble

According to the UBS index, Miami confidently ranks first among cities with the highest risk of a bubble. High rates are also recorded in Tokyo, Zurich, Los Angeles, Toronto and Geneva. These city problems are associated with a growing imbalance between housing prices and affordability for the population.

Moderate-risk cities

The moderate-risk group is headed by Amsterdam, Sydney, Boston, Vancouver, Frankfurt, Hong Kong, Tel Aviv, Singapore, Madrid and Munich. Among them is Dubai, which showed a low risk increase with a forecast for 2023.

Stable markets

The low-risk category includes San Francisco, New York, London, Paris, Warsaw, Stockholm and Milan. Of all the cities included in the study, Sao Paulo turned out to be the most stable, where the risk of a bubble is minimal. This is due to relatively slow price growth and more balanced demand.

What's happening with house prices?

Including 2021, real house prices in high-risk cities have fallen by an average of 20%

Average real house prices have increased by 2% compared to last summer. However, Paris and Hong Kong saw a 10% decline, while Warsaw and Dubai saw double-digit growth.

Demand and rent: new realities

Rent growth continues to rise, increasing by more than 5% on average over the past two years. This indicates that renting is becoming increasingly popular against the backdrop of declining affordability of housing.

Housing affordability

A decline in purchasing power has become one of the main factors. Compared to 2021, buyers will be able to afford 40% less living space, which is due to rising mortgage rates and a decrease in the volume of available lending.

Conclusion

The UBS study highlights alternative scenarios in the global property market. Global risks are easing, but regional and urban property markets continue to face local challenges.

Special attention should be paid to markets with rapidly rising prices, such as Dubai, and to regions with falling affordability, to avoid future shocks.